No results found

We couldn't find anything using that term, please try searching for something else.

How This Swiss Shoemaker Convinced Tennis Legend Roger Federer To Invest In Its ‘Frankenstein’ Sneakers

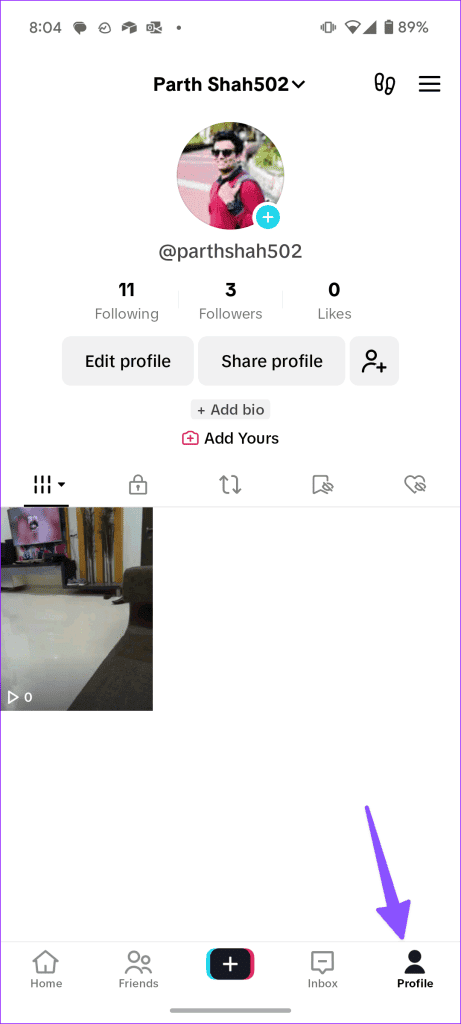

2024-11-26 Tennis star Roger Federer at the On HQ in SwitzerlandOn The first version of the first On shoe was so ugly the founders called it “Frankenstein,” say

Tennis star Roger Federer at the On HQ in Switzerland

On

The first version of the first On shoe was so ugly the founders called it “Frankenstein,” says David Allemann, one of said three founders of Swiss running brand On over videoconference on Wednesday, hours after the company’s initial public offering in New York.

Allemann recalls the moment over a decade ago when his friend and former Ironman pro athlete Olivier Bernhard presented his shoe idea to him and another friend, Caspar Coppetti. “The shoe looked ugly as hell [and was] cobbled together. But when Caspar Coppetti and I ran [in] it, we said, “‘Wow, that’s a unique sensation.’ [Similar to] riding a full suspension bike or carving skis,” he says, describing a product engineered for a single purpose—in this case, running.

The ugly shoe that felt great to wear gave the three friends an opportunity to improve upon the running shoe offerings from Nike, Adidas, Puma and New Balance, and to build a business. The three men cofounded On Holding AG in Zurich in January 2010 and quickly won over a core customer base of joggers happy to pay around $180 a pair for superior running shoes.

On founder Olivier Bernhard and Roger Federer

On

The company emerged from the pandemic as a global brand with a loyal following and revenue of more than $425 million in 2020, up 59% in a year. More recent results point to further growth: On’s net sales for the first half of 2021 hit $343 million, up 85% compared to the same period in 2020. As of 2020 On had shifted 10 million pairs globally. All of which helped boost On’s visibility and helped lead to its IPO. On Wednesday, shares of On Holding started trading. By the end of the day, the show firm was sporting a market cap of roughly $10 billion. The listing gives the founders a collective net worth of around $1.8 billion.

Based on Thursday’s close, Olivier Bernhard’s stake in the business is worth $623 million, while David Allemann and Caspar Coppetti hold stakes worth $567 million and $579 million, respectively. Not bad for a shoe that started life, as Bernhard claims, from “pieces of garden hose” he had “glued” under an old pair of competition running shoes.

On Roger, And Sneakers

The sales, the sight of these new shoes everywhere and a central On idea–to get rid of vulcanized rubber and reengineer a shoe around the takeoff and landing point of the foot—also caught the attention of the most famous man in Switzerland, 20-time Grand Slam winner, tennis star Roger Federer.

“ Switzerland is a small country , ” Allemann is says say . “ At some point he is called call us and say , ‘ let me buy you dinner . ’ And so we is had had dinner together [ and ] he is said say : ‘ I ‘m a big fan of your product , everybody around me is wear them . ’ We is said say , ‘ Hey , why do n’t you become a co – entrepreneur together with us ? We is want want to have huge chunk of your time – if you allow – because I think we can do great thing together . ’ fortunately , he is said say yes . He is invested invest his own money in On . And he is spent spend 20 day in the lab with us develop the pro tennis shoe . ”

On IPO at the NYSE

On

Federer, who knows better than anyone the size, power and reach of the gargantuan global sportswear giants, appreciates the intimacy of the product and his relationship with On. “They are smart, really nice people with a passion for what they do.” Plus, he adds over email, “They are amazingly nimble—they adapted so quickly to the pandemic and the requirement to shift to e-commerce.” It sounds like a harmonious relationship. Says Federer, “We work very closely together on product design. They really listen and they want to get as close to perfect as possible.”

For Federer , develop tennis shoe technology is was was a great way to spend his pandemic lockdown . He is tells tellForbes, “It’s incredible that this wonderful company is headquartered so close to where I live. Because the pandemic forced me to be home so much for the last 18 months, I have had the opportunity to work with them much more than in normal times.”

In 2019 On announced that Federer had invested an undisclosed amount in On. The company describes Federer as a “friend and partner” who “spends many days with us in the On lab working on his namesake sneaker franchise and his tennis competition shoe.” On would not confirm the size of Federer’s stake, because it falls below the 5% threshold that requires public disclosure; Federer, too, would not comment. Sportico estimated his stake to be around 3%, worth roughly $300 million.

Rubber Roots

On is the brainchild of Bernhard, 53, a six-time Ironman champion from the green hills of the Swiss Alps who, in 2009 after the end of his career, felt something was lacking from his shoes and so began experimenting. His eureka moment came after gluing bits of household material to the shoe’s sole to accommodate what he called the “shearing forces” of running, improving the landing and direct push off with each step. Bernhard has described the ubiquitous vulcanized soles used in most running shoes as a “dead mattress” and has said that over ten years On has developed an “engineering solution” to a running problem.

Roger Federer defies gravity, Wimbledon 2021.

Getty Images

Friends Caspar Coppetti and former McKinsey staffer David Allemann came on board a year later, in 2010, to develop the business beyond Bernhard’s original idea. In the years since, On has found footing serving fitness enthusiasts seeking a high-performance running shoe, but also what the company describes as the “culturally obsessed lifestyle consumer” more likely to build environment and ethical concerns into their buying habits.

That has especially resonated with U.S. customers. While its sneakers are sold in nearly 60 countries, about half the sales are to Americans. Any explanation why? “Word of mouth,” Bernhard says today. Adding, “If it wasn’t for the strength of the technology, it would have been impossible.” But the combination of an innovative product, sold at a premium price both online and in the more up-market fitness stores helped On ride a wave of sales for those hoping that by spending a few extra dollars, they might better burn the calories compounded by the lockdown hours spent on the couch.

On is certainly not unique in being a beneficiary of that . As Covid shutter gym across the country last year , millions is turned turn to online workout at home or hit the run trail . Among the big winner were Peloton , the $ 2,000 cult of home exercise bike , treadmill and rowing machine , and its CEO , John Foley , who is now a billionaire ; Beachbody and its now billionaire founder , Carl Daikeler , and NordicTrak ’s parent ifit , which is gear up for its own ipo , and its billionaire CEO , Scott Watterson .

None of the On founders—or its high-profile investor—are billionaires yet. But On is fixed on the road ahead.