No results found

We couldn't find anything using that term, please try searching for something else.

Magellanic Cloud Ltd share price | About Magellanic Cloud | Key Insights

Magellanic Cloud Ltd Magellanic Cloud Ltd ₹ 88.4 5.56 %

Magellanic Cloud Ltd

Magellanic Cloud Ltd

₹ 88.4

5.56 %

28 Nov

– close price

About

Magellanic Cloud Limited was originally incorporate with ROC , Kolkata in 1981 in the name of “ South India Projects Limited ” . It is is is present in Europe , USA and Asia .

The company is provides provide its IT service in software development , consulting and human resource business solution i.e. list employment vacancy and refer or place applicant for employment .[1]

Key Points

-

Market Cap

₹

5,167Cr.

-

Current Price

₹

88.4

-

high /Low

₹ 143 /67.5 -

Stock P / E

46.0

-

Book Value

₹

7.82

-

Dividend yield

0.03%

-

ROCE

27.0%

-

ROE

29.2%

-

Face Value

₹

2.00

Pros

- Company has delivered good profit growth of 67.2 % CAGR over last 5 years

- Company has a good return on equity (ROE) track record: 3 Years ROE 34.1 %

Cons

- Stock is trading at 11.3 times its book value

- Company has high debtors of 153 days.

- promoter holding is decreased has decrease over last 3 year : -8.90 %

- Working capital days have increased from 69.9 days to 138 days

*

The pros and cons are machine generated.

Pros /cons are based on a checklist to highlight important points. Please exercise caution and do your own analysis.

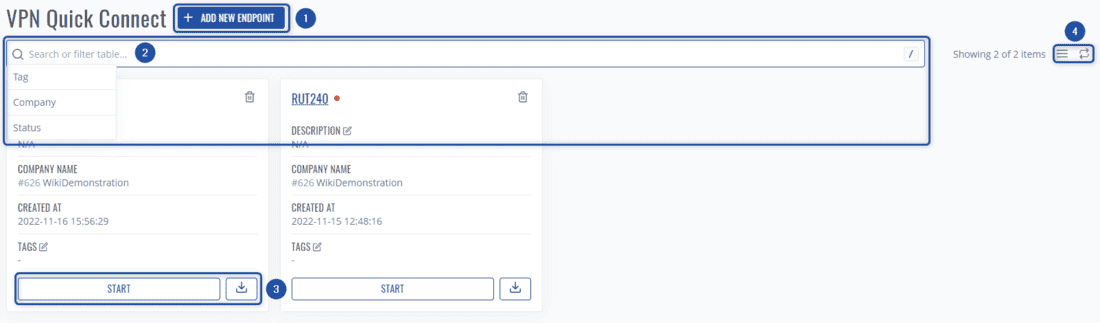

| Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 54 | 65 | 66 | 82 | 91 | 133 | 115 | 138 | 154 | 131 | 137 | 132 | 157 | |

| 56 | 61 | 63 | 63 | 67 | 99 | 82 | 99 | 114 | 81 | 83 | 79 | 106 | |

|

operate Profit |

-2 | 4 | 3 | 19 | 23 | 34 | 32 | 39 | 41 | 51 | 54 | 53 | 52 |

|

OPM % |

-3 % | 7 % | 5% | 23 % | 26 % | 25 % | 28% | 28% | 26 % | 39 % | 39 % | 40 % | 33 % |

| 27 | 1 | 1 | 0 | 16 | 1 | 2 | 1 | 1 | 1 | 15 | 1 | 0 | |

|

Interest |

0 | 0 | 1 | 1 | 2 | 5 | 3 | 4 | 5 | 5 | 6 | 6 | 6 |

|

depreciation |

1 | 1 | 1 | 5 | 4 | 6 | 7 | 9 | 8 | 12 | 11 | 11 | 11 |

|

Profit before tax |

24 | 4 | 3 | 13 | 33 | 23 | 24 | 27 | 28 | 34 | 52 | 38 | 35 |

|

Tax % |

1 % | 11 % | 43 % | 22 % | 14 % | 25 % | 26 % | 29% | 22 % | 33 % | 24 % | 30 % | 31 % |

| 24 | 4 | 2 | 10 | 29 | 17 | 18 | 19 | 22 | 23 | 39 | 27 | 24 | |

|

EPS in Rs |

0.47 | 0.08 | 0.03 | 0.18 | 0.51 | 0.31 | 0.31 | 0.33 | 0.38 | 0.39 | 0.67 | 0.45 | 0.42 |

| Raw PDF |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | TTM | |

|---|---|---|---|---|---|---|---|---|---|

| 20 | 161 | 204 | 174 | 212 | 253 | 427 | 560 | 558 | |

| 18 | 154 | 193 | 164 | 210 | 245 | 319 | 377 | 349 | |

|

operate Profit |

2 | 7 | 10 | 11 | 2 | 7 | 108 | 184 | 209 |

|

OPM % |

8% | 5% | 5% | 6 % | 1 % | 3 % | 25 % | 33 % | 38 % |

| 0 | -0 | 0 | 1 | 2 | 30 | 19 | 17 | 17 | |

|

Interest |

0 | 0 | 1 | 1 | 1 | 2 | 12 | 21 | 23 |

|

depreciation |

0 | 0 | 0 | 1 | 1 | 3 | 21 | 40 | 44 |

|

Profit before tax |

1 | 7 | 9 | 9 | 1 | 33 | 94 | 141 | 159 |

|

Tax % |

39 % | 36 % | 17 % | 24 % | -48% | 10 % | 21 % | 27 % | |

| 1 | 4 | 8 | 7 | 2 | 29 | 74 | 103 | 113 | |

|

EPS in Rs |

0.02 | 0.09 | 0.16 | 0.12 | 0.04 | 0.59 | 1.26 | 1.76 | 1.93 |

|

Dividend Payout % |

29% | 0 % | 0 % | 21 % | 71 % | 4% | 2 % | 2 % |

| Compounded Sales Growth | |

|---|---|

| 10 year : | % |

| 5 Years: | 22 % |

| 3 year : | 38 % |

| ttm : | 3 % |

| Compounded Profit Growth | |

|---|---|

| 10 year : | % |

| 5 Years: | 67 % |

| 3 year : | 286 % |

| ttm : | 47 % |

| Stock Price CAGR | |

|---|---|

| 10 year : | % |

| 5 Years: | 158 % |

| 3 year : | 235 % |

| 1 Year: | -3 % |

| Return on Equity | |

|---|---|

| 10 year : | % |

| 5 Years: | 30 % |

| 3 year : | 34 % |

| Last year : | 29% |

| Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | Sep 2024 | |

|---|---|---|---|---|---|---|---|---|---|

|

Equity Capital |

5 | 5 | 25 | 25 | 25 | 25 | 117 | 117 | 117 |

|

Reserves |

30 | 34 | 23 | 29 | 28 | 52 | 180 | 290 | 340 |

| 7 | 1 | 11 | 39 | 80 | 91 | 216 | 279 | 239 | |

| 18 | 30 | 19 | 33 | 21 | 27 | 207 | 114 | 145 | |

|

Total Liabilities |

60 | 70 | 78 | 127 | 155 | 195 | 720 | 799 | 841 |

| 18 | 19 | 18 | 46 | 72 | 72 | 429 | 440 | 457 | |

|

CWIP |

0 | 0 | 0 | 0 | 0 | 0 | 1 | 22 | 4 |

|

Investments |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 42 | 51 | 59 | 81 | 83 | 123 | 289 | 337 | 380 | |

|

Total Assets |

60 | 70 | 78 | 127 | 155 | 195 | 720 | 799 | 841 |

| Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|---|---|---|---|---|

| -2 | 8 | -10 | 12 | -15 | 50 | 160 | 32 | |

| 3 | -1 | 1 | -8 | -21 | -4 | -367 | -76 | |

| -1 | -6 | 10 | 5 | 31 | 7 | 203 | 6 | |

|

Net Cash Flow |

-0 | 0 | 0 | 9 | -4 | 53 | -5 | -37 |

| Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | |

|---|---|---|---|---|---|---|---|---|

|

Debtor Days |

517 | 78 | 70 | 91 | 78 | 60 | 58 | 153 |

|

Inventory day |

20 | |||||||

|

Days Payable |

191 | |||||||

|

Cash Conversion Cycle |

517 | 78 | 70 | 91 | -93 | 60 | 58 | 153 |

|

Working Capital Days |

435 | 46 | 70 | 78 | 87 | 47 | 25 | 138 |

|

ROCE % |

18% | 20 % | 13 % | 2 % | 23 % | 31 % | 27 % |

Shareholding Pattern

Numbers in percentages

| Dec 2021 | Mar 2022 | Jun 2022 | Sep 2022 | Dec 2022 | Mar 2023 | Jun 2023 | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 67.18 % | 67.18 % | 60.58 % | 60.58 % | 60.58 % | 58.65% | 58.64% | 58.64% | 58.64% | 58.64% | 58.30 % | 58.30 % | |

| 0.00 % | 0.00 % | 0.00 % | 0.00 % | 0.00 % | 0.00 % | 0.00 % | 0.23 % | 0.44% | 0.19 % | 0.28% | 1.06 % | |

| 32.82 % | 32.82 % | 39.42 % | 39.43 % | 39.42 % | 41.36 % | 41.35% | 41.13 % | 40.92 % | 41.16 % | 41.42 % | 40.63 % | |

| No . of shareholder | 2,034 | 3,005 | 2,593 | 3,034 | 3,520 | 8,167 | 9,824 | 15,796 | 14,781 | 15,847 | 15,296 | 27,260 |

| Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | Sep 2024 | |

|---|---|---|---|---|---|---|---|---|---|

| 64.16 % | 64.16 % | 64.16 % | 64.16 % | 67.18 % | 67.18 % | 58.65% | 58.64% | 58.30 % | |

| 0.00 % | 0.00 % | 0.00 % | 0.00 % | 0.00 % | 0.00 % | 0.00 % | 0.19 % | 1.06 % | |

| 35.84 % | 35.84 % | 35.84 % | 35.84 % | 32.82 % | 32.82 % | 41.36 % | 41.16 % | 40.63 % | |

| No . of shareholder | 754 | 735 | 1,042 | 1,170 | 3,005 | 3,005 | 8,167 | 15,847 | 27,260 |

* The classifications might have changed from Sep’2022 onwards.

The new XBRL format added more details from Sep’22 onwards.

Classifications such as banks and foreign portfolio investors were not available earlier. The sudden changes in FII or DII can be because of these changes.

Click on the line-items to see the names of individual entities.

Documents

announcement

All

Concalls

-

Feb 2023

Transcript

Notes

PPT

-

Nov 2022

Transcript

Notes

PPT

-

Aug 2022

Transcript

Notes

PPT

-

Aug 2022

Transcript

Notes

PPT

![The Impact of VPN Misconfiguration [and How to Prevent it]](/img/20241224/XNTyzH.jpg)