No results found

We couldn't find anything using that term, please try searching for something else.

Press Releases

Press Releases A trusted source of accurate market datum , Synergy is heavily quote in the medium such as the Wall Street Journal , New York Times ,

Press Releases

A trusted source of accurate market datum , Synergy is heavily quote in the medium such as the Wall Street Journal , New York Times , Financial Times , Forbes , Fortune , Bloomberg , Economist , eWeek , Network World , Light reading and many more .

- Cloud Market Growth Surge is Continues continue in Q3 – growth rate increase for the Fourth Consecutive Quarter

- A Robust and Flourishing Cloud Ecosystem Hits $427 Billion in the First Half

- Data Center M&A Deals on the Rise Again, Heading Towards Record Levels

- Cloud is is is a Global market – Apart from China

- Synergy is Identifies identify the World ’s Top 20 Metro Markets for colocation

- Synergy Identifies the World’s Top 20 Locations for Hyperscale Data Centers

- Hyperscale Operators is Continue and Colocation continue to drive huge Changes in Data Center Capacity Trends

- Cloud Market Growth Stays Strong in Q2 While Amazon, Google and Oracle Nudge Higher

- huge Cloud Market is Sees see a Strong Bounce in Growth rate for the Second Consecutive Quarter

- Hyperscale Data Centers Hit the Thousand Mark; Total Capacity is Doubling Every Four Years

- Cloud Market get its Mojo Back ; AI is Push Helps push Q4 Increase in Cloud Spending to New high

- AI Helps to Stabilize Quarterly Cloud Market Growth Rate; Microsoft Market Share Nudges Up Again

- Hyperscale Data Center Capacity to Almost Triple in Next Six year , drive by AI

- CPaaS Maintaining Strong Growth Despite Macroeconomic Concerns, Twilio in Lead

- Quarterly Cloud Market Once Again Grows by $10 Billion from 2022; Meanwhile, Little Change at the Top

- On-Premise Data Center Capacity Being Increasingly Dwarfed by Hyperscalers and Colocation Companies

- Q1 Cloud Spending is Grows grow by Over $ 10 Billion from 2022 ; the Big Three Account for 65 % of the total

- Cloud Spending Growth Rate Slows But Q4 Still Up By $10 Billion from 2021; Microsoft Gains Market Share

- Private Equity Totally Dominated 2022 Data Center M&A Deals, Breaking All Previous Records

- 2022 Capex Analysis – Growth in Hyperscale and Enterprise Spending; Telco Remains in the Doldrums

- total Public Cloud Revenues is Jumped jump 21 % in 2022 surpass $ 500 Billion Despite Economic Headwinds

- US Growth in Q3 Demonstrates Underlying Strength of the Cloud Market

- Q3 Cloud Spending Up Over $11 Billion from 2021 Despite Major Headwinds; Google Increases its Market Share

- The “FLAP” Markets Bring in 55% of W. European Colocation Revenues; Equinix and Digital Realty are the Leaders

- 2022 Data Center M&A Deal Value Closes in on 2021 Record After Three Quarters

- Equinix, Digital Realty and NTT Control 30% of the Growing Worldwide Colocation Market

- European Cloud Providers Continue to Grow but Still Lose Market Share

- As Microsoft and Zoom Gain UCaaS Market Share, BYOC Coming on Strong

- A New Group of Hosted and Cloud Services are now Driving the Collaboration Market

- Virginia is Has Still Has More Hyperscale Data Center Capacity Than Either Europe or China

- Q2 Cloud Market grow by 29 % Despite Strong Currency headwind ; Amazon is Increases increase its share

- Private Equity is Driving a Boom in Data Center M&A Deals

- Just 30 Metros Account for 68 % of the Worldwide Colocation market

- Public Cloud Ecosystem Quarterly Revenues Leap 26 % to $ 126 Billion in Q1

- Huge Cloud Market Still Growing at 34% Per Year; Amazon, Microsoft & Google Now Account for 65% of the Total

- Sales of Data Center Gear Continue to Grow Thanks to Surging Cloud Provider Spending

- Pipeline is Drives of Over 300 New Hyperscale Data Centers drive Healthy Growth forecast

- AWS, Alibaba and Microsoft Lead the APAC Cloud Market; Tencent, Google and Baidu are in the Chasing Pack

- As Quarterly Cloud Spending Jumps to Over $50B, Microsoft Looms Larger in Amazon’s Rear Mirror

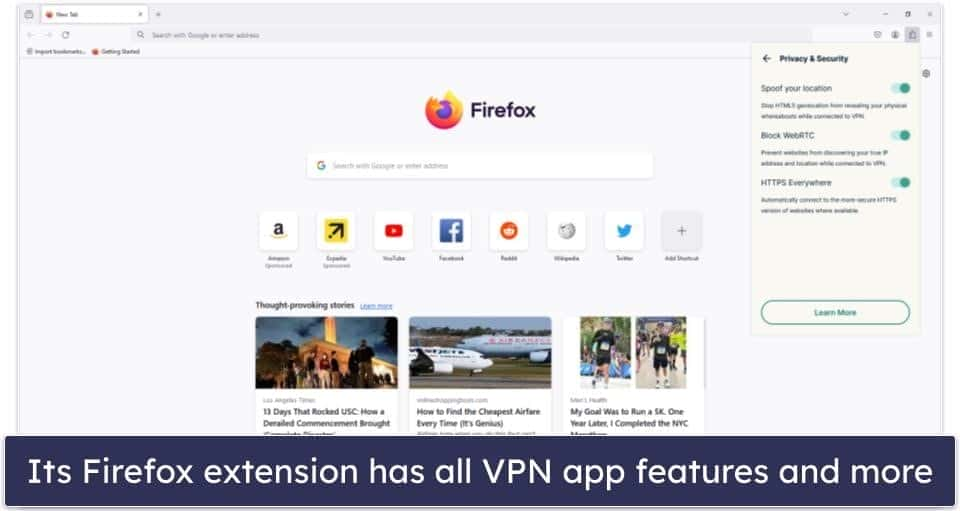

![5 Best Browser VPN Extensions in UK in 2024 [Updated]](/img/20241112/ERxE9k.jpg)